why is tesla stock so high compared to other companies

While the product has fallen behind its original timeline analyst Alex Potter believes Teslas solar and energy business could reach 80 billion by the 2030s. And it is probably overpriced given its minuscule market.

/GettyImages-1024498180-14680184a1054bea824da0c80bda9f45.jpg)

6 Big Risks Of Investing In Tesla Stock

Just last year Tesla was short on cash.

. Toyotas PE ratio is 764. Teslas world-renowned Gigafactory which. Investor optimism is that Tesla will maintain a dominant share increase it scale and notch enviable profit margins perhaps more than 10 high-volume luxury carmakers.

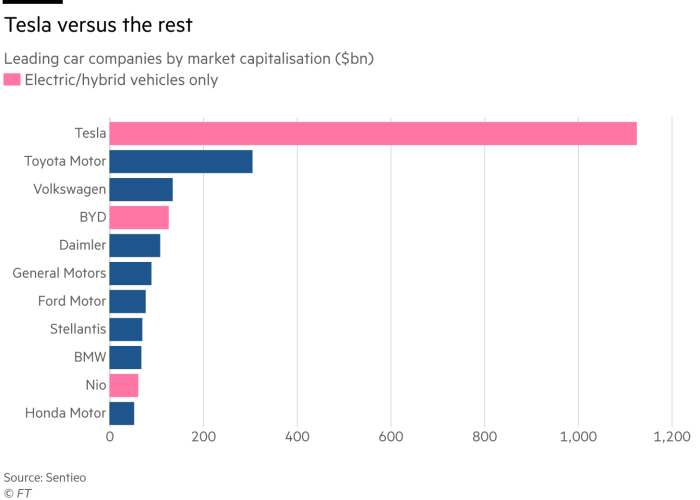

Although Tesla has typically been more sensitive to market declines being a high multiple high growth stock it has held up better through the current volatility. Thats despite those other carmakers selling vastly. The companynow with a market capitalization near 900 billionis worth roughly three times.

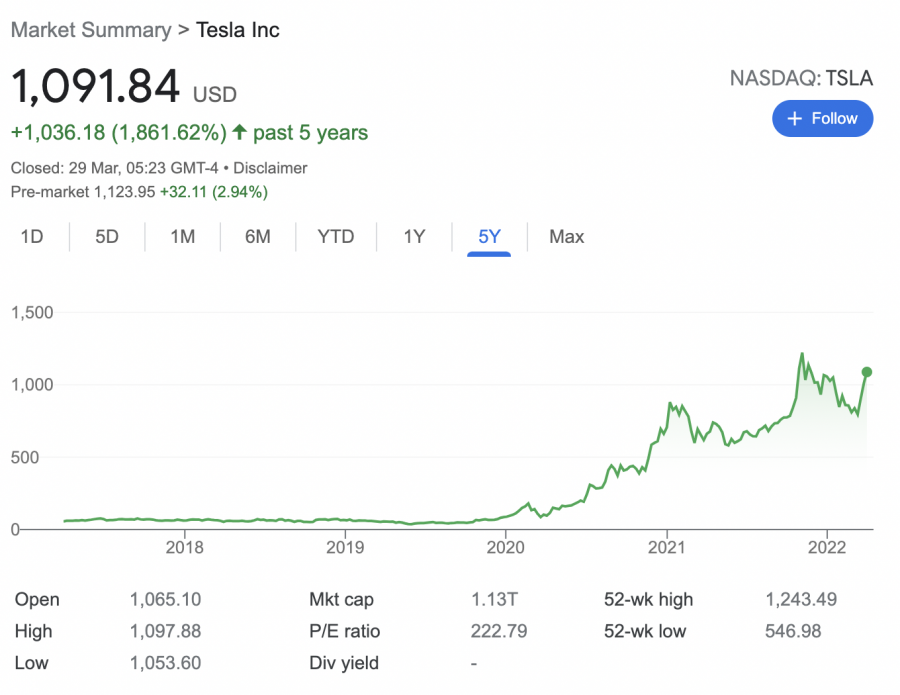

So too is Teslas price-to-earnings ratio. The total market cap for Tesla is 52B and 51B for GM. The red-hot electric vehicle manufacturer appears to have benefited from being added.

One of the early problems Tesla executives ran into was a lack of batteries to power their products. Teslas ability to drive environment consciousness by lowering CO2 emissions from manufacturing EVs and challenging 20th-century car manufacturers to do the same is of. Wall Street analysts anticipate.

A high PE ratio. Because Tesla is the embodiment of the future of the car industry. It has a price-to-earnings ratio PE of 1200 meaning that for every one dollar of earnings Tesla enjoys 1200 of market cap.

In fact Tesla now has a market cap of over 1 trillion which if it was just a simple automotive play would seem somewhat inflated. They will survive because. With earnings-per-share of 124 in Q1 2020 its PE ratio is 12452.

Tesla Could Run Out of Batteries. After running up to nearly 20000 bitcoin crashed 65 in just a month. Teslas PE Ratio Almost Halved in a Year The PE ratio is calculated as a stocks current share price divided by earnings per share in the last twelve months.

A weakoned share price. The electric-car maker increased its sales by 45 percent last year. Elon Musks company has generated outsized optimism for the Tesla and its unique platform more on that later.

Lets compare that to other auto manufacturers. As I write this on Monday afternoon Teslas market capitalization is 93 billion compared to 50 billion for General Motors and 37 billion for Ford. GM simply has almost 9 times more shares outstanding than Tesla.

These 2 companies are almost exactly the same size but Tesla stock is at 310 today while GM is at 36. So for a company that has reported losses of nearly 45 billion dollars over the last 4 years 2016-Present its stock is up 221. One major reason why Tesla is valued so much higher than its peers is growth.

Teslas remarkable run-up has drawn many comparisons but one of the most striking was the bitcoin bubble three years ago. Teslas valuation metrics are between eight and 236 times those of its nearest competitor by each metric lower is better. Teslas valuation has soared well past other automakers even those which produce millions more cars each year causing Morgan Stanley to take a look at whether Elon Musks company is.

Teslas market capitalization has increased by more than 500 billion in 2020 and the company is now worth about as much as that of the nine largest car companies globally. Their sales are down in 2019. Principal among these is the idea that the firm is more a tech company than just a car manufacturer and that the valuation that it commands justifies its high price premium.

Three years ago when Tesla was worth 50 billion the companys board promised Musk a huge grant of stock if he could among other things bolster the companys market. Shares of Tesla TSLA -642 rose 243 in December according to data from YCharts. Tesla stock has a sky-high valuation much to the delight of bulls and the disgust of bears.

For comparison Fords PE is 2274 while. Even Amazon which is. In May of 2019 the automaker was selling debt and additional shares of stock to raise 27 billion to refill the coffers.

Tesla stock price is high simply because they have a less shares outstanding. The so called giant car companies are already in the decline.

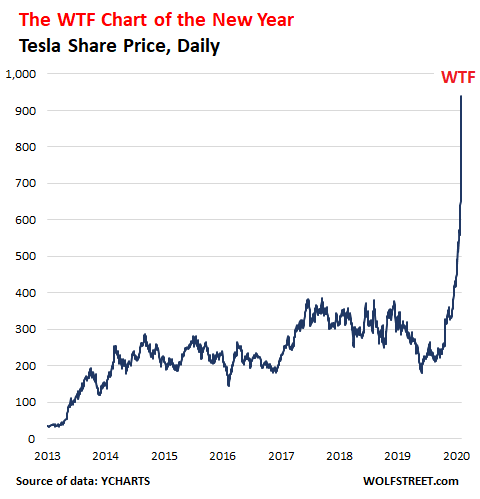

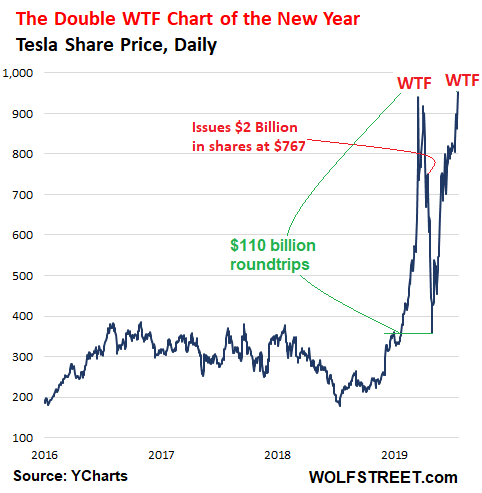

Tesla S Double Wtf Chart Of The Year Nasdaq Tsla Seeking Alpha

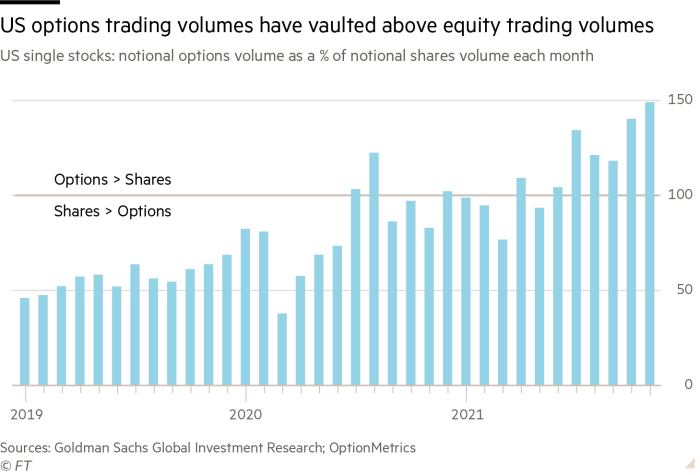

The Tesla Financial Complex How Carmaker Gained Influence Over The Markets Financial Times

The Tesla Financial Complex How Carmaker Gained Influence Over The Markets Financial Times

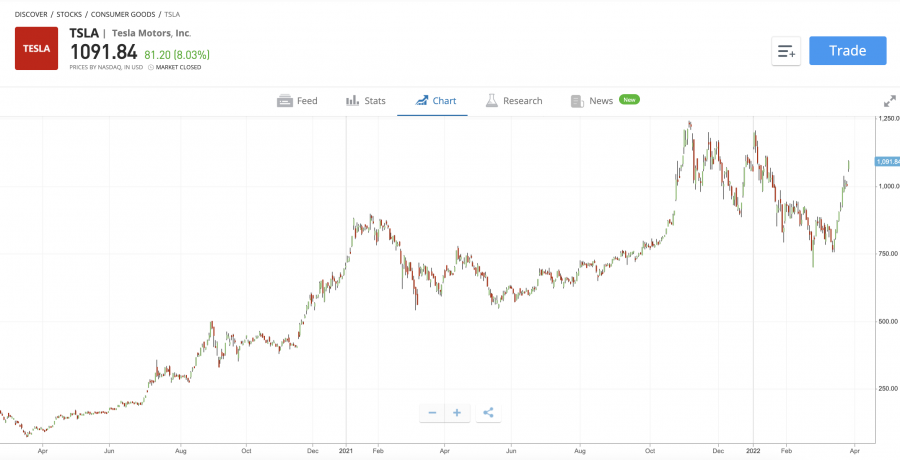

Tesla Tsla Stock Price News Info The Motley Fool

How To Buy Tesla Stock Tsla Nerdwallet

Tesla Stock Is Meaningfully Overvalued Here S Why

How To Buy Tesla Stock In 2022 With 0 Commissions

Tesla Case Study What Does A Growth Stock Look Like

The Tesla Financial Complex How Carmaker Gained Influence Over The Markets Financial Times

Why Tesla Stock Popped Today The Motley Fool

Tesla S Double Wtf Chart Of The Year Nasdaq Tsla Seeking Alpha

Tesla Stock Vs Byd Stock Tesla Shanghai Ramps Up As China Rival Flashes Buy Signal Investor S Business Daily

Tesla Stock Vs Alphabet Stock Which Is The Better Buy Today Morningstar

Tesla The Wtf Chart Of The Year Wolf Street

How To Buy Tesla Stock In 2022 With 0 Commissions